Artificial Intelligence (AI) is transforming every aspect of business operations, but few areas have felt its impact as profoundly as finance and accounting. From automating journal entries to predicting cash flow, AI-driven systems are enabling organizations to achieve new levels of speed, accuracy, and strategic insight.

One of the most significant advancements is the application of AI in account-to-report processes, where automation reduces manual intervention and enhances compliance. Platforms like AI in Account-to-Report are redefining how financial data is managed, validated, and reported across enterprises.

The Evolution of Finance through AI

The finance function has traditionally been data-heavy and compliance-driven, requiring precision and timeliness. With AI entering the landscape, organizations are shifting from reactive financial reporting to proactive and intelligent decision-making.

From Manual to Machine Intelligence

Earlier, finance teams relied on spreadsheets and legacy systems to manage accounting cycles. Today, AI automates repetitive processes such as data entry, account reconciliations, and error detection. Machine learning algorithms can analyze massive data sets to detect anomalies, forecast trends, and suggest corrective actions before issues escalate.

Real-Time Visibility and Decision Support

AI-driven finance platforms provide real-time visibility into financial performance. CFOs can access dynamic dashboards and analytics that offer deep insights into operational efficiency, helping them make faster, data-backed decisions. This is especially useful in account-to-report (A2R) cycles, where delays in data consolidation can impact reporting timelines and accuracy.

Key Benefits of AI in Finance Automation

The adoption of AI in finance and accounting delivers measurable advantages that go far beyond simple automation.

1. Enhanced Accuracy and Reduced Errors

AI eliminates human errors by automating calculations, reconciliations, and data entries. Natural Language Processing (NLP) models interpret unstructured financial data from invoices and contracts, ensuring precision in financial statements.

2. Streamlined Workflows and Improved Efficiency

AI tools can process thousands of financial transactions within seconds. By automating repetitive processes, finance professionals can focus on higher-value strategic tasks like forecasting and budgeting.

3. Predictive Financial Insights

Machine learning enables predictive analytics that forecast future financial performance. It identifies spending patterns, cash flow issues, and potential risks, empowering organizations to act before challenges arise.

4. Strengthened Compliance and Audit Readiness

AI ensures that financial records are compliant with accounting standards and regulatory requirements. Automated systems can maintain audit trails and instantly flag non-compliant entries, simplifying audits and reducing risks.

AI Use Cases in Finance and Accounting

AI’s impact spans multiple areas across the financial ecosystem, from routine bookkeeping to complex risk analysis.

Automated Account-to-Report Cycles

The account-to-report process involves collecting, processing, and delivering accurate financial data to stakeholders. AI streamlines each phase of this cycle — automating journal entries, reconciling accounts, and generating real-time financial reports. Solutions such as ZBrain’s AI in Account-to-Report Agent enable seamless data flow across ERP systems, improving speed and consistency.

Smart Dunning and Payment Recovery

Another powerful example of AI in action is automated dunning management. The Automated Dunning Agent by ZBrain intelligently manages overdue payments by sending personalized reminders based on customer behavior and payment history.

Instead of relying on rigid, one-size-fits-all communication schedules, the AI agent adapts its messaging tone, frequency, and timing for each customer. This results in higher collection rates, reduced Days Sales Outstanding (DSO), and improved customer satisfaction — all while minimizing manual follow-up efforts.

Invoice and Expense Management

AI also transforms invoice processing by automatically capturing, validating, and matching invoices against purchase orders. Optical Character Recognition (OCR) and machine learning models help detect discrepancies instantly, preventing duplicate or fraudulent payments.

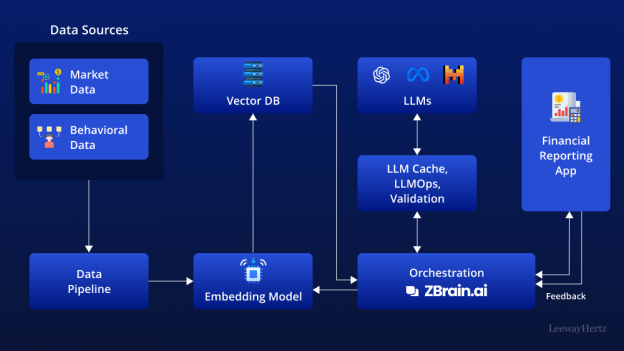

How ZBrain Enables Intelligent Finance Automation

ZBrain, a GenAI orchestration platform, empowers businesses to build and deploy domain-specific AI agents tailored to financial operations. These agents are capable of understanding complex workflows, extracting insights from large data volumes, and interacting with ERP systems in real time.

By combining automation, data orchestration, and intelligent workflows, ZBrain enables organizations to:

- Reduce operational costs through end-to-end automation

- Accelerate reporting cycles with zero manual delays

- Enhance compliance and accuracy across financial documents

- Improve customer communication and payment recovery through intelligent agents

ZBrain’s no-code orchestration capability allows finance teams to configure and customize AI workflows without deep technical expertise. Whether it’s automating the A2R process or managing dunning communications, ZBrain’s platform ensures flexibility, transparency, and scalability.

The Future of AI in Financial Transformation

As AI technologies evolve, their role in financial management will only grow more sophisticated. Predictive modeling, generative AI, and autonomous agents will soon take on advanced tasks such as risk modeling, tax optimization, and regulatory interpretation.

Forward-thinking finance leaders are already embracing these capabilities to transform their departments from cost centers into strategic business partners. The integration of GenAI platforms like ZBrain represents a major step toward a future where finance operations are not just automated — they are intelligent, adaptive, and continuously improving.

Conclusion

AI is no longer just an enabler in finance; it’s becoming the core engine driving accuracy, efficiency, and strategic foresight. From optimizing account-to-report cycles to revolutionizing dunning management, solutions like ZBrain’s AI agents demonstrate the immense potential of intelligent automation.

Organizations that invest in these technologies today are not only modernizing their financial operations but also future-proofing them for a data-driven world.

Keep an eye for more latest news & updates on Magazine!